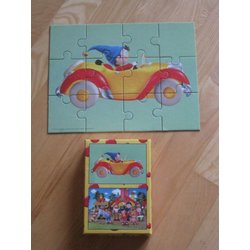

Novo 8pcs flip avtomobilčki za otroke zlitine potegnite nazaj modela avtomobila igrače veter vozila, ki plujejo pod raketa, smešno, dirke avto otroci fantje darilo naročilo ~ Debelo - www.bioenergetikdiagnostik.si

Štiri-kolesni Pogon Inercialni Off-road Vozilo Pullback Igrača Avto Plastičnih Trenja Stunt Anti-spusti Potegnite Nazaj, Avto Igrače Za Fante nakup / nova | www.programmatic.si

Novo 8pcs flip avtomobilčki za otroke zlitine potegnite nazaj modela avtomobila igrače veter vozila, ki plujejo pod raketa, smešno, dirke avto otroci fantje darilo naročilo ~ Debelo - www.bioenergetikdiagnostik.si